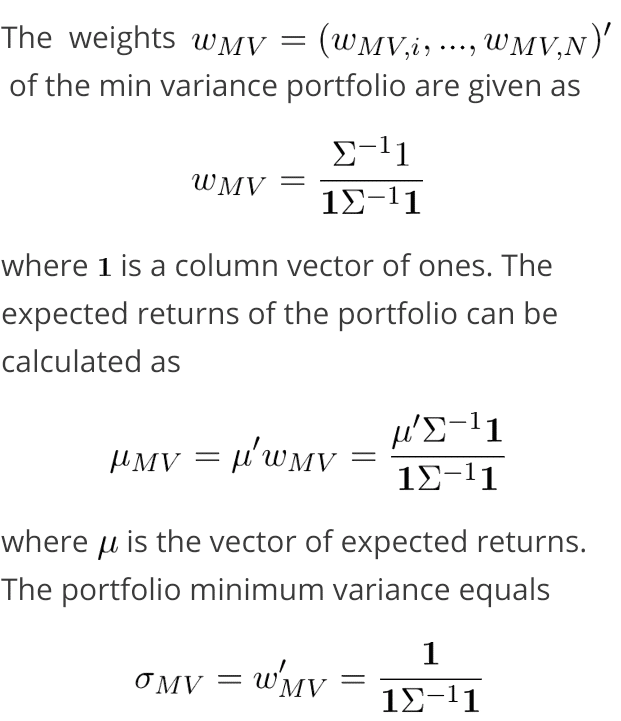

Portfolio diversification formula

The rationale behind this technique contends that a portfolio. If the constituents are equally weighted the portfolio standard deviation ie.

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

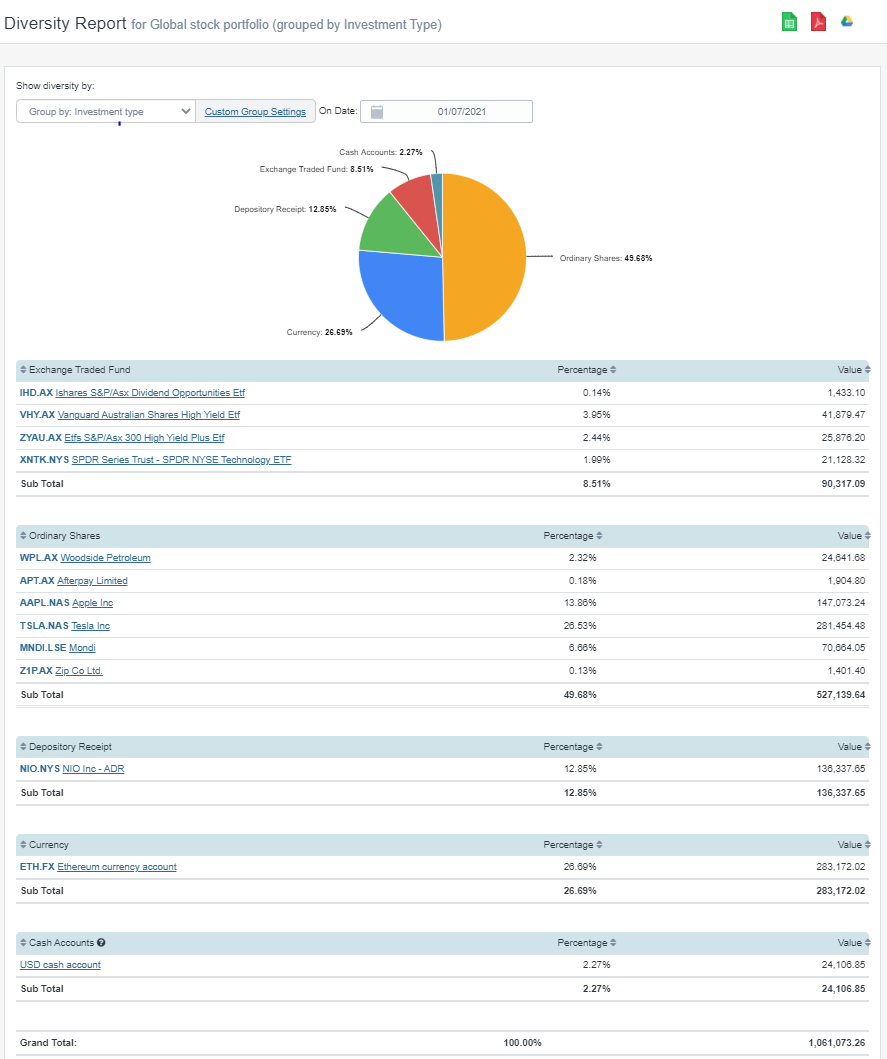

With a concentra- tion ratio of 50 the example portfolio has the.

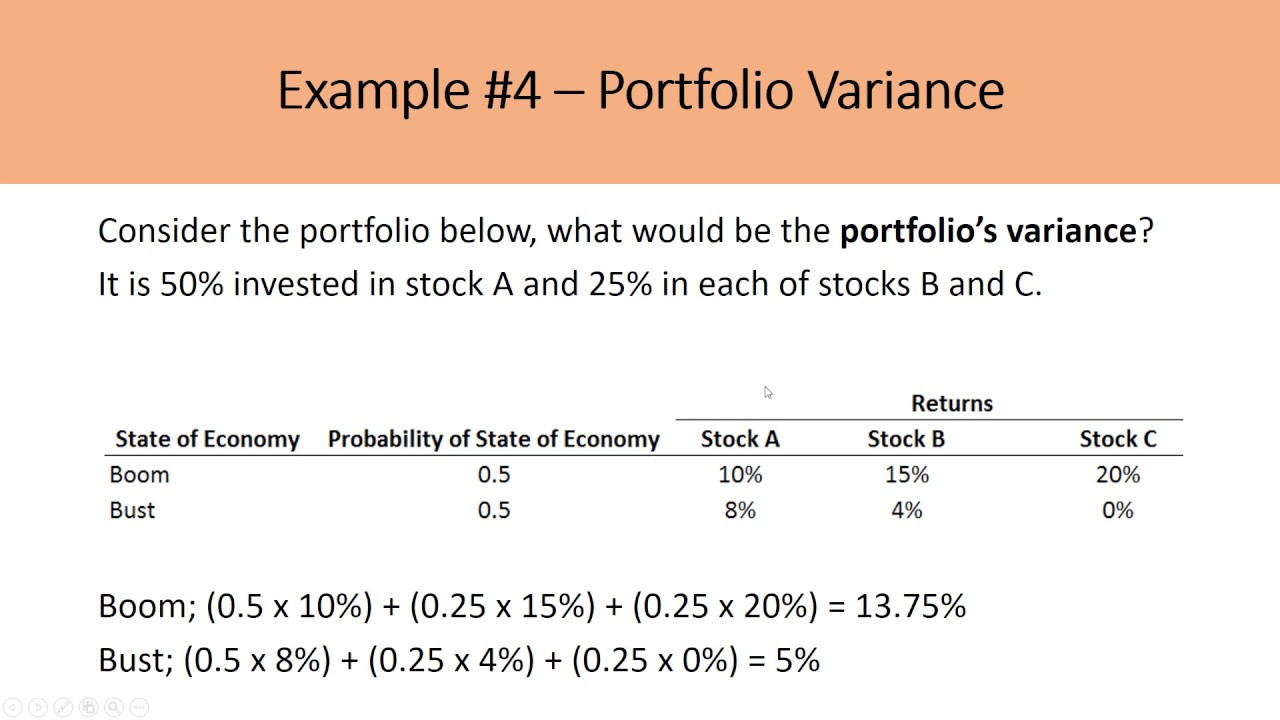

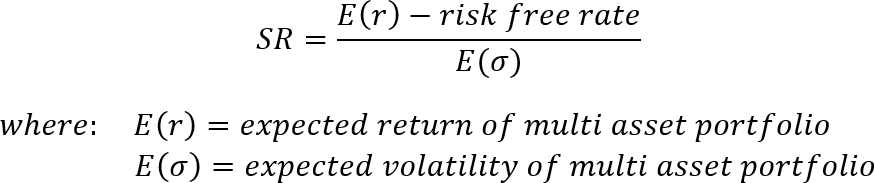

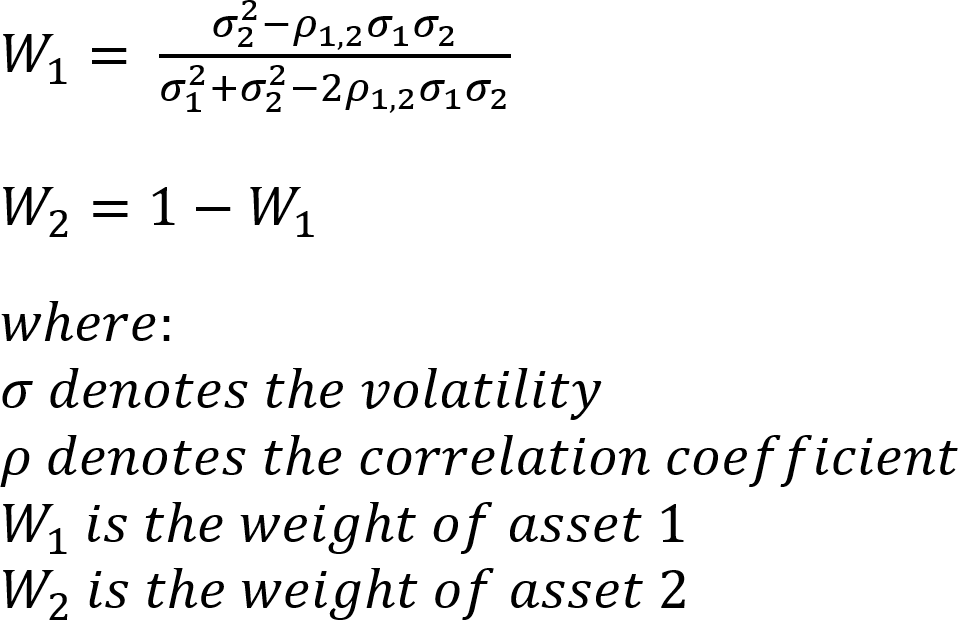

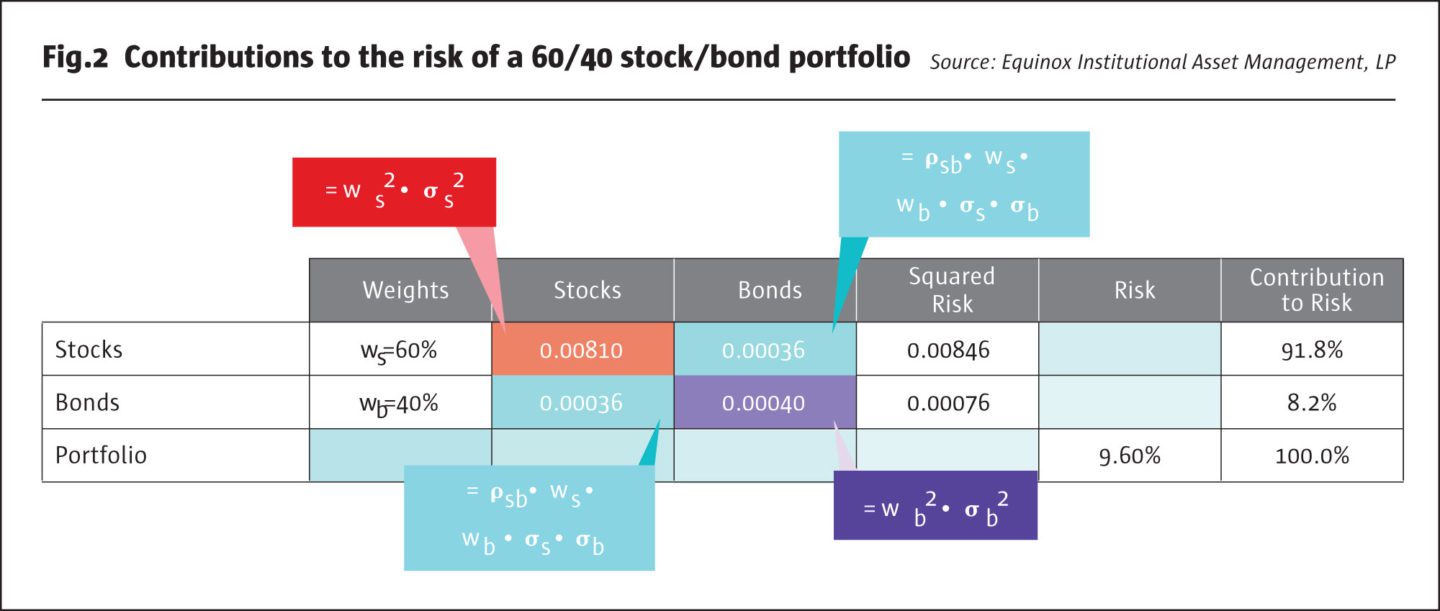

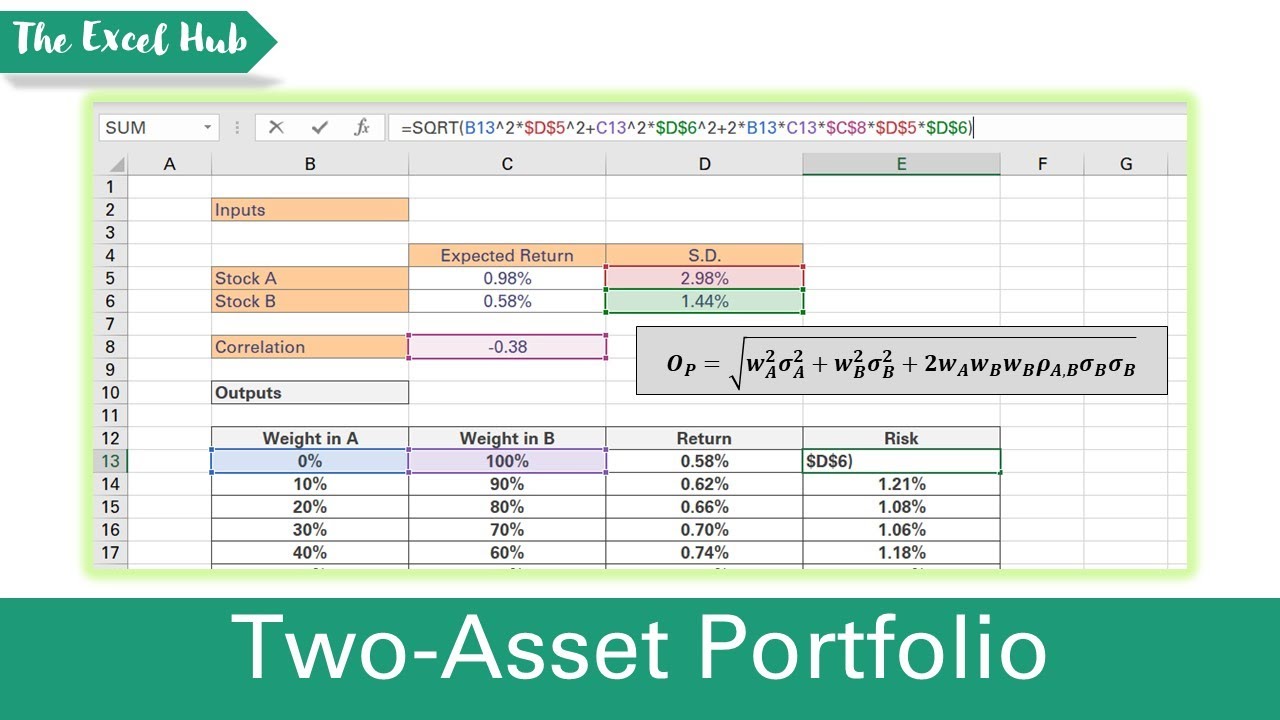

. The variance for a portfolio consisting of two assets is calculated using the following formula. The correlation coefficient is calculated by taking the covariance of the two assets divided by the product of the standard deviation of both assets. Thus in an equally weighted portfolio the portfolio variance tends to the average of covariances between securities as the.

It discusses the diversification ratio. Var Rp w21Var R1 w22Var R2 2w1w2Cov R1 R2 Where Cov R1 R2 represents the covariance of the two asset. The formula for portfolio variance is given as.

Domestic consumers utility function is given by u cH α cF α where cj α denotes state α consumption of good j j H F. Because the mean return is the same a simple measure of the value of diversification is calculated as the ratio of the standard deviation of the equally weighted. The Factors that Drive Asset Returns and the Efficiency of Diversification.

It discusses the diversification ratio. Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. Portfolio diversification is the risk management strategy of combining different securities to reduce the overall investment portfolio risk.

I have written many times. W i the weight of the ith asset. Formula for Portfolio Variance.

Too few stocks and one blowup hurts the portfolio by a noticeable amount. It can help mitigate risk and volatility. The weight of one asset multiplied by its return plus the weight of the other asset multiplied by its return.

Too many stocks and you run the risk of a very expensive index fund. INVESTMENT PRINCIPLES - Information Sheet for CFA Professionals In this example the required rate of. This lecture is the Part 03 of series of lectures on Portfolio Management.

The volatility is calculated as. Square root of the sum of variance divided by number of. The formula for calculating an.

As the number of assets grows we get the asymptotic formula. Ad Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals. Expected Return 40005000 10 10005000 3 08 10 02 3 86 Standard Deviation Standard.

The Diversification Quotient If the portfolio consists of N loans of equal size then the concentration ratio is 1N. Learn More About American Funds Objective-Based Approach to Investing. Pretty simple right.

The expected return of the portfolio is. Thus the goodsindifference curve is given by u cH α cF. A Fund With Unexpected Upside In Undervalued Companies Traded At Discounted Values.

Ad Help Your Clients Reach Their Goals W One Of Our Top Performing Funds.

Solactive Diversification The Power Of Bonds

Diversification Financial Edge

Solactive Diversification The Power Of Bonds

Calculate Your Investment Portfolio Diversification With Sharesight

Portfolio Management Theories In 2022 Portfolio Management Financial Management Accounting And Finance

Reit Or Real Estate Investment Trust All You Need To Know Real Estate Investment Trust Real Estate Investing Investing

Minimum Variance Portfolio Simplified Meaning Examples All You Need

Portfolio Diversification How To Diversify Your Investment Portfolio

Portfolio Diversification How To Diversify Your Investment Portfolio

Diversification Of Portfolios Matlab Simulink Example

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

Proper Asset Allocation Of Stocks And Bonds By Age New Life Financial Samurai Stocks And Bonds How To Get Money Bond

5 Productive Stock Market Risk Management Strategies Risk Management Market Risk Risk Management Strategies

The Risk Contribution Of Stocks The Hedge Fund Journal

Portfolio Returns And Risks Covariance And The Coefficient Of Correlation

Calculate Risk And Return Of A Two Asset Portfolio In Excel Expected Return And Standard Deviation Youtube

/conservativeportfolio-tardi-d19760c073f44c5b94bf060071963751.jpg)

What Is A Financial Portfolio